401k to roth ira conversion calculator

A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free income in retirement. Compare 2022s Best Gold IRAs from Top Providers.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth 401 k Conversion Calculator This calculator will show the advantage if any of converting your pre-tax 401 k to a Roth 401 k.

. This calculator compares two alternatives with equal out of pocket costs. This convert IRA to Roth calculator estimates the change in total net worth. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You.

Say youre in the 22 tax bracket and convert 20000. Converted plan balance is allowed to grow tax-free and all withdrawals are tax-free as well. With the passage of the American Tax Relief Act any.

This calculator can show you the consequences of such a decision. Ad Understand Your Options - See When And How To Rollover Your 401k. 1 current versus future tax rates 2 avoiding the taxable required minimum.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after-tax Roth 401. Roth 401 k to Roth IRA Conversions If your 401 k plan was a Roth account then it can only be rolled over to a Roth IRA.

This calculator will analyze your information and give you how much you could expect for each option you have which includes rolling over into a Roth IRA rolling over into another type of. A conversion has both advantages and disadvantages that should be carefully considered before you make a decision. A conversion has advantages and disadvantages that should be carefully considered before a decision is made.

Once converted Roth IRA plans are not subject to required minimum distributions RMD. It increases your income and you pay your ordinary tax rate on the conversion. Roth IRAs arent tax.

Many roth ira conversion calculator for excel articles discuss the interplay between three variables. This calculator compares two alternatives with equal out of pocket costs. This calculator will demonstrate the difference between taking a lump-sum payment from your 401 k and saving it in a tax-deferred account until retirement.

Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping your Traditional IRA vs. One big decision is whether or not you should convert your traditional IRA into a Roth IRA. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

This calculator will help you to compare the net effects of keeping your traditional Individual Retirement Account versus converting it to a Roth IRA. Converting it to a Roth. The rollover process is straightforward.

Schwab Has 247 Professional Guidance. Not only will the calculator show you the. See an estimate of the taxes youd owe if you.

Reviews Trusted by Over 45000000. It Is Easy To Get Started. 401k or Roth IRA calculator.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. A Roth IRA conversion is a tool that allows individuals to convert money from a tax-deferred retirement account like a traditional IRA or 401k into a Roth IRA. A conversion has both advantages and disadvantages that should be carefully considered before you make a decision.

A Roth conversion is an optional decision to change part or all of an existing tax-deferred retirement plan such as a 401 or a traditional IRA to a Roth IRA. Your income for the tax year will. First enter your current age the.

First enter the current balance. As of January 2006. Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement.

Traditional 401k or Roth IRA Calculator Traditional 401 K Or Roth 401 K Calculator Calculate your earnings and more A 401 k can be an effective retirement tool. This calculator can help you decide if converting money from a non-Roth IRA s including a traditional rollover SEP or SIMPLE IRA to a Roth IRA makes sense. Ad Converting Your 401k to a Roth IRA.

Learn More with Fidelity. Although it is possible to convert an IRA at any age this calculator does not take Required Minimum Distributions RMD into account which begin at age 72 or 70 12 if you were born. Roth IRA Conversion Calculator Use this Roth IRA conversion calculator to project the inflation-adjusted after-tax value of your Traditional IRA or 401k at retirement versus the inflation.

Ultimate Retirement Calculator Our Debt Free Lives Retirement Calculator Retirement Calculator

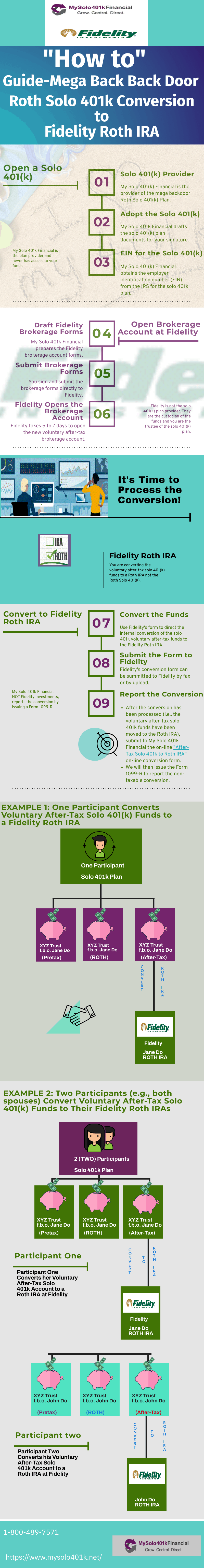

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

5 Times A Roth 401k Conversion Is A Good Idea Above The Canopy

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

Roth Ira Conversion Ameriprise Financial

The Average 401k Balance By Age Personal Capital

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

Roth Ira Conversion Calculator Converting An Ira Schwab Roth Ira Conversion Roth Ira Conversion Calculator

Systematic Partial Roth Conversions Recharacterizations

How To Do A Backdoor Roth Ira Contribution Safely Roth Ira Contributions Roth Ira Roth Ira Conversion

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

How To Rollover An Ira To 401 K District Capital Management

The Bold And Beautiful Roth Conversion Ladder Clipping Chains

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Over The Roth Ira Income Limit Considering A Backdo Ticker Tape

Roth Ira Conversion Calculator Excel